How to Save $5000 in a Year

Last Updated: February 12, 2022 • 7 min read

Author: Chelsea L.

Disclosure: This page may contain affiliate links and we may receive a commission through them, but this is at no additional cost to you. For more information, please read our privacy policy.

Let’s break this down even further into seven simple steps.

1. Figure out your “WHY”

It might sound cheesy, but giving this money a purpose makes it a whole lot easier to save. If you know the “why” then you will be more motivated and dedicated to your goal. This especially helps if you are saving up for something fun, but can still be useful no matter what you are saving up for.

Here are some ideas of things you could save $5,000 for:

- Family vacation

- Pay down student loans

- New home appliance and/or furniture

- Start a business

- Massive shopping spree

- Home remodel project

- Pay off credit card debt

- Retirement

2. Share Goal and Excitement With Your Spouse or Friend

After you’ve figured out your “why” share it! Having the people closest to you know about your saving goal can be very motivating and keep you accountable. If this is a goal that involves the help of your spouse, definitely fill them in and get their input. They may offer a different perspective that can help you out in the long run.

Tip: Have your accountability partner check in with you periodically to see how you are doing with this savings goal. This will help keep you focused until the goal is achieved.

3. Review Your Budget

Now that you have an idea of how much you are saving and who is helping you with that goal, you need to figure out how you are going to accomplish it. This can be done by reviewing your budget. Look at your monthly budget and go down the list of your monthly expenses. Is there any category that you are overspending on?

This step might be hard to complete if you have no idea what your finances look like. I highly recommend creating a budget and updating/reviewing it at least biweekly.

I created our budget on Google Sheets many years ago and we just continue to update it as time goes on. Our original budget was not as extensive as ours is now, and yours doesn’t have to be either. And if making and updating a budget sounds like too much work, maybe start with a budgeting app. Mint, Everydollar, and TrueBill are all great budgeting apps that you can customize to your needs. I have personally used each of them and know that they can help.

4. Set Up a Separate Account

This step is probably my favorite as I love to organize. For a more focused approach to this goal, I recommend setting up a separate account to put your savings in. Your current bank should allow you to open another savings account for free and most can even allow you to name the account. Make sure that you check if there is an account minimum though so you don’t get any fees from going below the minimum.

5. Make Automatic Transfers to Saving Account

Next, you need to set up automatic transfers to this new savings account. This will take money from your checking account and put it into the savings account however often you set it up to and for however much you want. I recommend having these transfers set up for right when your paycheck hits so that it’s easier for you to not rely on that money.

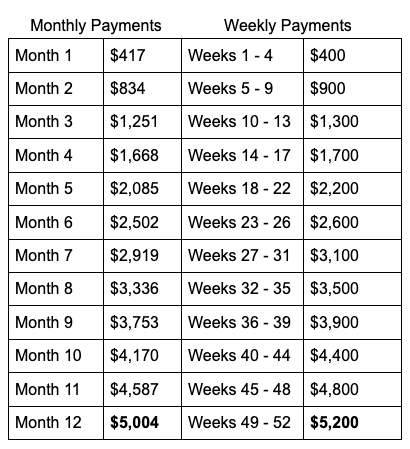

The amount you transfer and how often you do it up to you. If transferring one big chunk of change a month is easier for you (I recommend spacing it out from other large expenses like your rent/mortgage) then do that. Or you may like thinking in terms of weeks and take out a smaller amount more often. Here is a chart to show you the two ways that I’d recommend breaking up the deposits totally up to $5,000 (or maybe a little over).

6. Reduce your spending

Remember in step three when I mentioned reviewing your budget? Well knowing how much you spend and what you spend it on isn’t all that needs to be done to save more. I wish it were that easy! Now you need to decide where you can cut some spending to save that extra $417 monthly.

Keep in mind, this does not need to come from one area of spending. Most likely it will be an accumulation of multiple cutbacks. Here are a few that I recommend.

- Look at your Utility/Phone/Internet/Insurance bills and see if you can save by switching plans or companies.

Utility: We lowered our monthly utility bill by getting a Nest. Each summer we get a rebate of $50 from our Utility company by having a Nest.

Phone: Phone carriers are often having sign-up deals for new customers. If your contract is about to be up, look into competitors’ offers and make the switch. If this doesn’t work, think of joining your plan with some family members to get the family account discount.

Internet: Just like phone carriers, internet companies are always having special deals for new customers. Look at what your internet company is offering for new customers and ask if they’ll match it for you. We have done this multiple times, and while we don’t always get the same deal, we are always able to lower our bill.

Insurance: Insurance companies are notorious for raising your claims after the first year. Have your insurance agent shop around for better plans for you.

Another easy way to save money is to stop spending so much on food. The average American eats out 18 times a month! Buying easy-to-make meals can help you to eat out less, save money, and maybe even eat healthier.

Here are a few more ideas for saving some extra money:

- Buying bulk items for things you purchase regularly

- Cancel unnecessary subscriptions

- Thrift or borrow items when you can

- Try a spending freeze on non-essentials

7. Increase your income

While saving $5,000 a year is doable, it can be a lot easier to achieve if you also find ways to earn more money. We have written a lot of blog posts on side hustles that you can do to earn some extra money. Here are a few of them.

- 21 Best Side Hustles

- 5 Hobbies That Can Earn You Money

- How to Make Money Taking Photos

- How to Make Money As a Kid

- 5 Options for Stay-at-Home Parents Who Want to Earn More Money

- How to Make Money Building Websites

- 13 Side Hustles for Nurses to Make More Money

If side hustles are not your thing, look into ways that you can invest your money. There are so many different avenues for investing that we will share in the future, but here are a few articles that we’ve written about investing.

Make sure to continue to check your budget and savings account regularly. Making more money can sometimes lead to “lifestyle creep”. This is when you start to spend more money and you earn more and that will significantly affect your savings goals.

Hope you enjoyed these steps on earning an extra $5,000 a year. Best of luck!