What are the Property Taxes in Nevada vs California in 2024?

Last Updated: May 29, 2023 • 7 min read

Disclosure: This page may contain affiliate links and we may receive a commission through them, but this is at no additional cost to you. For more information, please read our privacy policy.

With inflation rising at a rapid rate, it can be useful to compare the tax burdens that you may have in order to make smart financial decisions to lower your annual taxes and increase your tax return. Property taxes can greatly affect your tax liability and moving from areas with higher rates for a better option can make a significant difference overall. Since property taxes vary from state to state the areas in which you purchase property can make a big difference. Let's compare how it would look when deciding between a property in Nevada versus a property in California.

Nevada vs California Property Taxes

The state of Nevada’s average property tax rate is .6%, which is among the lowest rates in the United States. California’s average property tax rate is higher at .76%, although still under that national average of 1.19%. This means that there is a difference of .16% between the two states' averages. Tax rates vary on municipality, therefore if you have a property in California your tax rate could be higher or lower than .76% depending on where your property lies. The same goes for Nevada and its property tax rates. For example, Las Vegas property taxes can be as high as .75%.

The property tax rates of these two states are similar and applied to the same valued property could be thousands of dollars depending on the full cash value of the property. This might not seem like a huge difference but you have to consider that the value of the property in each state differs as well and a home the same size will be taxed significantly more in California than in Nevada as both its tax rate and property value will be higher.

If you are curious how these rates look in other states of the country. Hawaii has the lowest rate with an average of .28% and New Jersey has the highest rate at 2.49%. Knowing these numbers it's easier to see that Nevada taxes are on the lower end with Nevada residents paying an average of .6%.

What Is Property Tax?

Property tax is a tax by local governments to fund specific improvements and benefits in the area. The purpose of this tax is to maintain and improve the local community. This tax is paid by the current property owner and is usually combined with the monthly mortgage payment. If the mortgage of the property is already paid off, the government will send a bill to the property owner. The amount of taxes owed on the property is calculated by applying the local property tax rate with the fair market value of the real property, which includes the land. The fair market value of the property is assessed on a yearly basis by a county assessor. Property tax rates follow the proportional tax structure and do not vary by income level. This tax rate will typically have a cap on its annual increases depending on the area. Since property taxes vary by jurisdiction it is essential to know the rate of the property taxes for the local area where your property resides.

Property Tax Exemptions

There are property tax exemptions that are given to certain people that qualify. Most homeowners are subject to paying property taxes, but there are individuals that can be exempt from paying. Those that may qualify are senior citizens, veterans, those with disabilities, School Tax Relief (STAR) participants, certain nonprofit businesses, and religious entities. Some low-income programs may also exempt a homeowner from being liable for property taxes. Depending on the state, you may qualify for a homestead exemption which will reduce the assessed value of your primary residence, or home's taxable value, to lower your property taxes. These exemptions vary by municipality and it is important to know what is available to you in your area so you can have the most tax savings.

Property Tax Uses

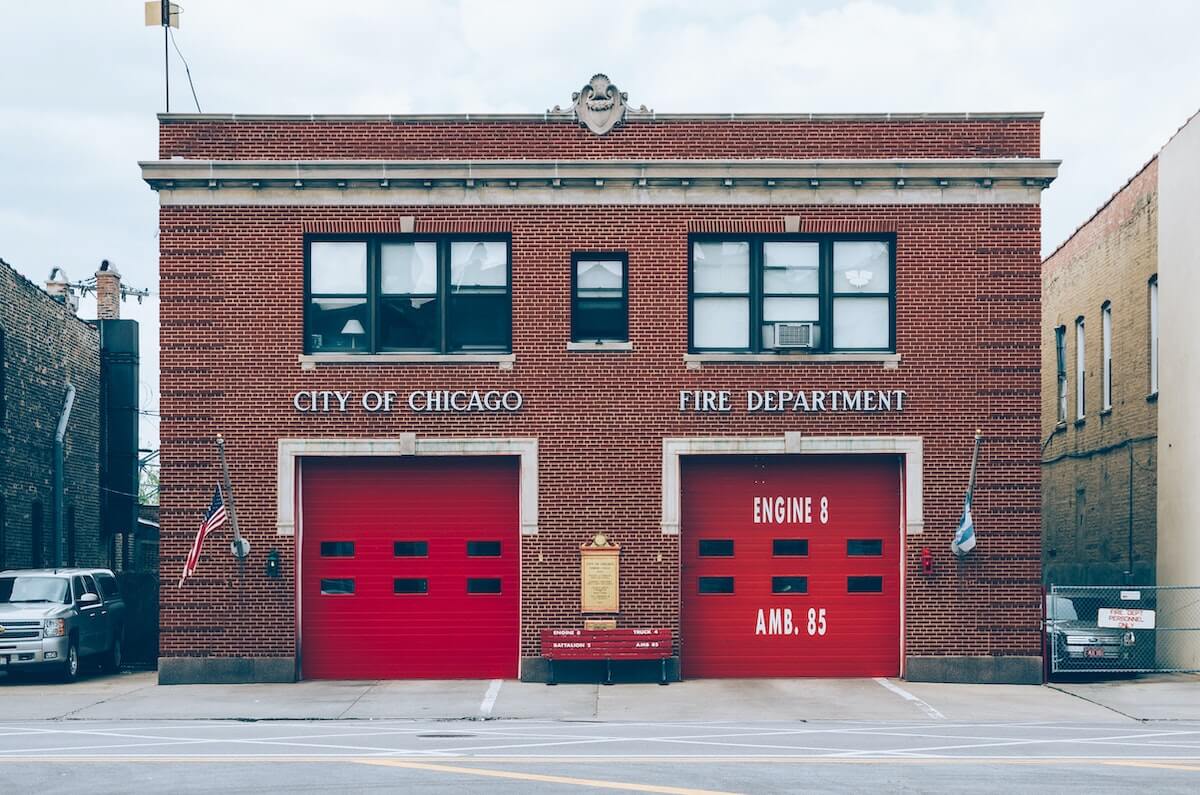

While paying taxes on your property might not sound like a good thing, you are probably benefiting a lot from the things that money pays for. Property taxes are used to maintain and improve the local community where the property resides. The maintenance and improvements typically include education, law enforcement, fire protection, libraries, road and highway repairs, water and sewage, and more. This means that local school districts receive money from the taxes you pay along with the library building you frequent. Your safety and protection are also due to these tax payments on your property.

Frequently Asked Questions

What Are Property Taxes in Nevada vs California?

In California, property taxes typically range from 1.1% to 1.6% of the assessed land value. In contrast, Nevada boasts some of the lowest property tax rates in the nation, with an average of only 0.77% of the assessed land value.

This significant disparity in property tax rates between the two states highlights the more favorable tax environment for property owners in Nevada. It is important to note that property tax rates may vary within specific regions or local jurisdictions.

Do Property Taxes Change?

Yes. A new property tax bill leading to new property tax rates will change how much you owe in taxes. Also, the value of the property will usually change year by year leading to a change in property taxes owed. If you do any repairs or upgrades to the property it can also increase the total cost of your property taxes as the fair market value of the property will be higher.

Is It Worth Moving From California to Nevada?

After reviewing these tax rates you may wonder if it is worth it to move from California to Nevada. That depends. If you are looking to make a move in order to lower your property taxes then it is a better idea to make the move from California and own property in Nevada instead. Nevada has the ninth lowest average property tax rates and compared to California’s average tax rates can lead to roughly .16% in savings (depending on the municipality where you move).

Overall you will spend a lot more money on taxes if you live in California, but you most likely will be making more money. California residents median household income is almost $20,000 more than Nevada’s is at $65,686. Deciding whether the move is ‘worth it’ lies on many variables and your unique circumstances and preferences. Second homes purchased in Nevada versus California will typically have a lower property tax.

Is It Cheaper to Live in Nevada or California?

Yes, it is cheaper to live in Nevada than in California. As mentioned earlier, Nevada has lower property taxes than California. Nevada also has no state income taxes and the amount you will pay to own property in Nevada is significantly less as the median home value is also lower. The median home price in Nevada is $291,800 versus California’s $550,800.