Social Security Disability Approval Rates by State (2024)

Last Updated: February 17, 2023 • 6 min read

Disclosure: This page may contain affiliate links and we may receive a commission through them, but this is at no additional cost to you. For more information, please read our privacy policy.

The United States Social Security Administration is the name of the American government agency that handles all Social Security matters. This includes Social Security Disability benefits. What are Social Security Disability benefits, anyway? If you know anything about supplemental security income (SSI benefits) you may be familiar with these benefits also. Social security benefits are available to people in America who fit certain criteria. We will go over the criteria for Social Security Disability benefits and what the approval rates are by each state.

It doesn't matter if you live in New Mexico, Rhode Island, South Dakota, North Carolina, New Jersey, or elsewhere in the vast nation. If you submit your medical records that indicate your age and current disability status, you may be able to receive Social Security Disability benefits on a monthly basis. Certain factors influence the benefit amount significantly as well. The Social Security Administration calculates social security disability claims with the assistance of "average indexed monthly earnings."

What Exactly Is the Social Security Act?

Understanding the origins of this well-known benefit program may be helpful to people who want to find the necessary information. Understanding disability programs and how they work may benefit your approval rating. The Social Security Act of 1935 established the Social Security Program. It covered everything from age-related insurance to unemployment insurance. The aim behind it was to accommodate the various requirements of individuals who were unemployed, elderly or otherwise disadvantaged in the nation. Reading about this act may be relevant to people who want to grasp eligibility requirements. It may make completing disability applications a lot simpler and more straightforward as well.

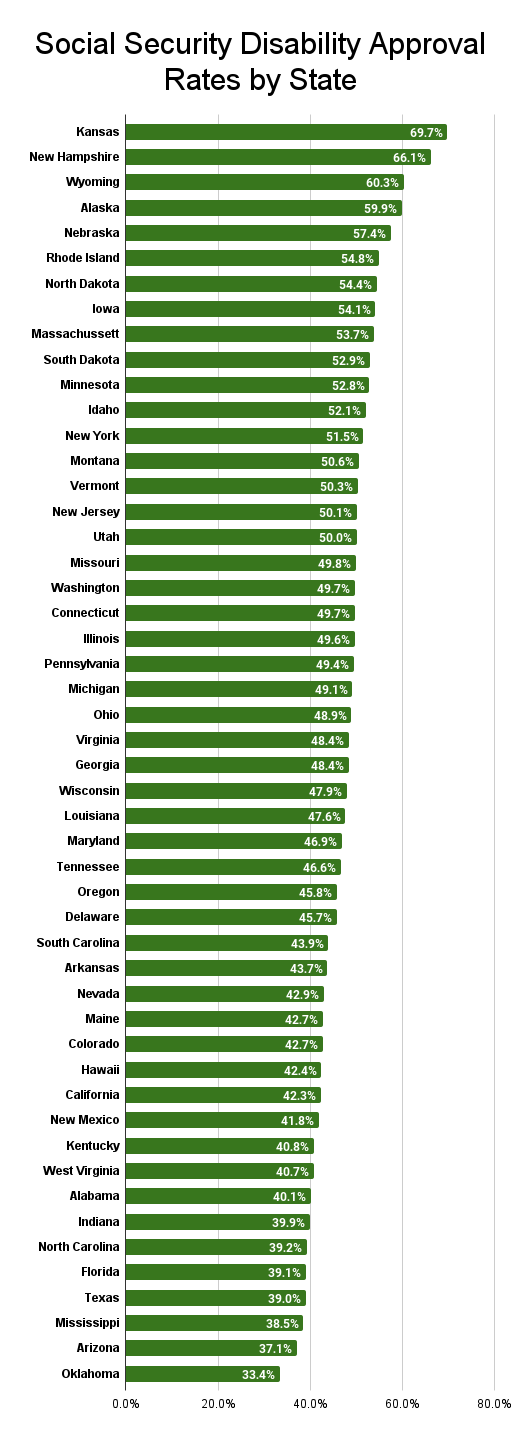

Social Security Approval Rates by States

Assessing the best and worst states for Social Security rates may give individuals clarity regarding the in-depth application process. Which state offers a higher approval rate? Which state has a lower average wait time? Analyzing the national average approval rate and nationwide approval overall can potentially eliminate a lot of uncertainty and frustrating time wasting. It can be particularly helpful to people who want to learn about Social Security matters for the first time.

Below are the the approval rates of each state starting with the highest and ending with the lowest.

SSD Benefits and Highest Approval Rates

Are you interested in SSD benefits? The average national approval rate for these specific benefits is 45.22 percent. These are the five states that offer the highest approval rates for this particular category:

- Kansas (69.7%)

- New Hampshire (66.1%)

- Wyoming (60.3%)

- Alaska (59.9%)

- Nebraska (57.4%)

Other examples of approval rates for SSD benefits are 49.6% (Illinois), 39.9% (Indiana), 42.9% (Nevada), and 51.5% (New York).

SSD Benefits and Lowest Approval Rates

There are a total of eighteen states in the nation that offer SSD benefit approval rates that are lower than the previously mentioned average. The following states have approval rates that are a minimum of six percent less than the average in the country. These states are:

- Florida (39.1%)

- Texas (39%)

- Mississippi (38.5%)

- Arizona (37.1%)

- Oklahoma (33.4%)

The Rest of the States and Approval Rates

If you want to make handling the initial application stage simpler, you should make sure you have the latest information regarding your specific state. It may give you a much higher chance of doing things correctly. Getting legal advice may help you as well. Setting up a free consultation with a qualified lawyer may provide you with significant insight regarding the ins and outs of the federal program and how it operates these days.

- Rhode Island (54.8%)

- North Dakota (54.4%)

- Iowa (54.1%)

- Massachussetts (53.7%)

- South Dakota (52.9%)

- Minnesota (52.8%)

- Idaho (52.1%)

- Montana (50.6%)

- Vermont (50.3%)

- New Jersey (50.1%)

- Utah (50.0%)

- Missouri (49.8%)

- Washington (49.7%)

- Connecticut (49.7%)

- Pennsylvania (49.4%)

- Michigan (49.1%)

- Ohio (48.9%)

- Virginia (48.4%)

- Georgia (48.4%)

- Wisconsin (47.9%)

- Louisiana (47.6%)

- Maryland (46.9%)

- Tennessee (46.6%)

- Oregon (45.8%)

- Delaware (45.7%)

- South Carolina (43.9%)

- Arkansas (43.7%)

- Maine (42.7%)

- Colorado (42.7%)

- Hawaii (42.4%)

- California (42.3%)

- New Mexico (41.8%)

- Kentucky (40.8%)

- West Virginia (40.7%)

- Alabama (40.1%)

- North Carolina (39.2%)

Application Process Success and More

What's the best way to boost your approval rating odds if you have a severe disability? Try to learn about common reasons that lead to disapproval in your state and elsewhere. If you have a legitimate claim that corresponds with your financial needs properly, that's a strong start. Try to find the name of a disability advocate or subscriber lawyer who may be able to talk to you about disability claimant matters and beyond. Make a point to ask pertinent questions that involve technical denials, your substantial gainful activity, the appeals council, the privacy policy, and other topics. Learning about these things may affect the final decision on whether you qualify for these benefits. Remember, getting a consultative examination can go a long way. People who submit the majority of applications may not be aware of the additional information they can include.

Consider reaching out to an agency that specializes in Disability Determination Services as well. These state agencies concentrate on disability findings and because of that may be able to provide you with information that's accurate and comprehensive. Their representatives may be able to talk to you about your state's denial rate, too.

Once you zero in on SSI disability approval rates, you can figure out precisely what you can do to boost your odds of success. This can be advantageous regardless of where you live. Make a point to go to the doctor on a routine basis for your medical conditions. If you do not do this for any reason, it may hurt your application. If you want your medical determination to be fair, you should prioritize frequent physician appointments. It's imperative to stay on top of your health. Doing so can essentially confirm that your specific condition makes you eligible to receive benefits.

Again, you can also recruit the guidance of a seasoned social security advocate or social security disability attorney. These individuals have a lot of knowledge that involves updated regulations and more. They know about nonmedical reasons that can influence approvals, too.

It's critical to discuss at length just how your disability stops you from being able to attain and maintain employment. The more transparent you are, the easier it may be for you to get approval. Provide sufficient details.